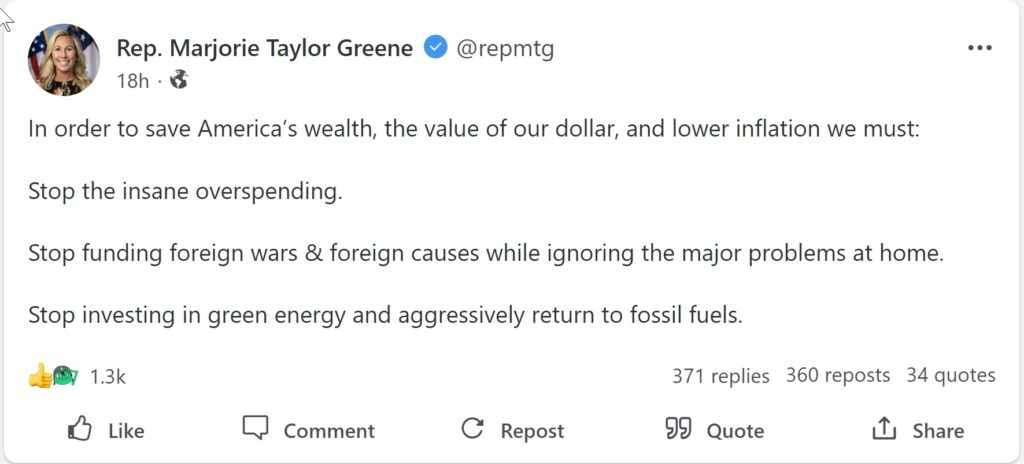

Representative Marjorie Taylor Greene of Georgia, whom I generally like and admire, recently Gabbed thus:

Here we are in the land of “How?” And a most challenging land it is.

The “How?” question is at the base of many of the evils embedded in federal taxation, spending, and policy. It’s thorniest when policies pertinent to national legislation clash with conditions that vary according to region, state, or Congressional district. In practice, it cannot be answered in a fashion that won’t harm anyone’s interests.

For our first example, let’s address the income tax. Among its villainies is that it’s a national tax on individuals: a blatant departure from the principles of federalism and subsidiarity. That was inevitable once the Sixteenth Amendment was ratified. Every provision of any income tax legislation therefore applies throughout the United States. That gives rise to an unholy dynamic, founded on an ancient wisdom:

No One Wants His Ox Gored.

Thus, income tax laws have proliferated that feature both:

- High tax rates that rise as income rises;

- A multiplicity of exemptions that cater to particular constituencies.

And thus, we get the following sort of thrust and parry:

Congressman 1: We must reduce federal tax rates!

Congressman 2: Agreed, but we must also be fiscally responsible.Congressman 1: Well, yes. But the tax rates must come down.

Congressman 2: How do you propose to cover next year’s budgeted expenditures?Congressman 1: We can eliminate some exemptions.

Congressman 2: Very well, how about these? (Indicates exemptions prized by the other’s constituents)

At this point there comes a moment of frozen silence. Congressman 1 is aware of what the loss of that exemption would do to his prospects for retaining office…as is Congressman 2. While Congressman 1 might be sincere about the need to lower federal tax rates, he’s probably even more sincere about retaining his seat in Congress. Congressman 2 has hit him there for a perfectly obvious reason.

The same sort of thrust-and-parry would apply with equal force to reductions in federal spending:

Congressman 1: We must reduce federal spending!

Congressman 2: Agreed, but we must also cover the nation’s important needs.Congressman 1: Well, yes. But spending must come down.

Congressman 2: How do you propose to reduce it?Congressman 1: We can eliminate some unnecessary subsidies.

Congressman 2: Very well, how about these? (Indicates subsidies prized by the other’s constituents)

See how easy it is? Every pro-spending legislator knows the drill. The anti-spending legislators, by virtue of their desire to remain in office, are thus easily disarmed. Representative Greene would face exactly this sort of counter were she to seek reductions in outlays for which she has called.

What makes it worse is that there is a large body of “constituents” who are represented by no one and answer to no one: the millions of federal bureaucrats in the “alphabet agencies.” All of them seek greater status: bigger titles, larger budgets, more subordinates, and larger areas of responsibility. Reductions in federal spending would cross-cut the agendas of some of them, no matter where in the budget they might occur. Thus reductions in federal outlays would incite some of them to work against whatever Congressmen are seen to be behind them.

You and I fear the federal government. Congressmen fear the bureaucracies. They’ve been taught to do so.

So, Representative Greene, while I agree with your sentiments, I await your demonstration of how they can be realized. Slam that little word how.