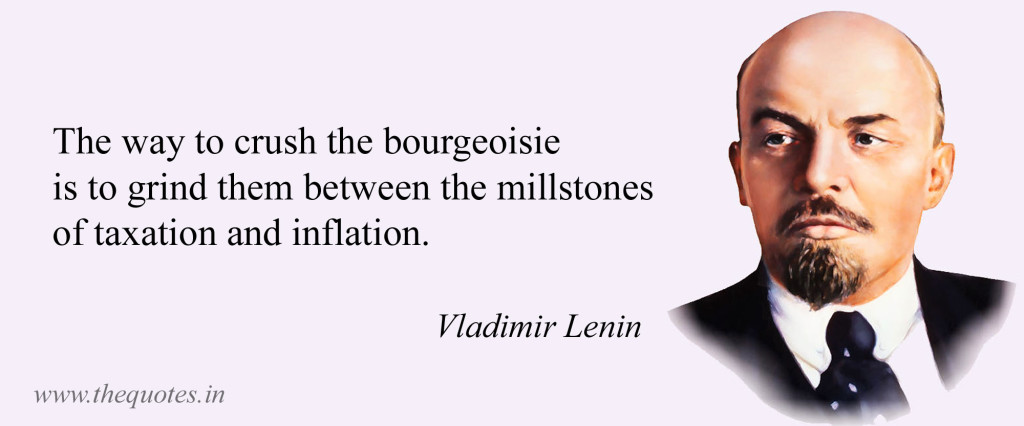

Now that it appears that the Usurpers are determined to destroy the dollar through Lenin’s favorite tactics, it seems appropriate to review some of the developments that arose in the wake of America’s last great surge of inflation. And while correlation is not a definitive proof of causation, I think a strong case can be made that inflation was one of the drivers for changes that have largely been to the detriment of the American social and economic order.

The inflation of the Seventies began during the Nixon Administration. It was partly a consequence of Nixon’s 1971 decision to “close the gold window:” i.e., to end the redemption-in-gold of dollars held by non-Americans. The dollar’s value began to fall at that point, with a concomitant rise in the general price level of all goods and services. The part most Americans who lived through it remember most vividly was the sharp increase in the price of gasoline.

The Ford and Carter years merely saw the intensification of the trend. The Federal Reserve was still creating money rapidly, to meet Congress’s borrowing demands, and prices were rising just as rapidly. Of course, the political class was determined that it not be blamed for the price increases, and so strove to focus attention on the makers of goods. Yet the problem was from first to last a monetary phenomenon.

One of the major social changes that accompanied high inflation was the mass movement of American women into the wage-employment workforce. For some families, that was a matter of utter necessity; for others, it was a mandatory component of second-wave feminism; for still others, it was “what all my friends are doing.” The consequence was a sharp increase in family incomes as denominated in dollars. The increase was sufficient to propel families into spending increases in excess of the amount militated by inflation. (“Expenditure rises to meet income, and tends to exceed it.” – C. Northcote Parkinson)

Needless to say, with ever greater quantities of dollars chasing a far more slowly growing supply of goods and services, prices had to rise higher still. But that was only one effect of the socioeconomic changes. A woman in wage employment will have less time for other things than a woman who “stays at home.” For the first time in American history, millions of children were given over to supervision by non-relatives.

In pondering this development, we must not overlook the taxation factor. Federal taxes remained relatively stable, but state and local taxes were galloping north. Property taxes and sales taxes were especially affected by the explosion of incomes – always upward. This greatly intensified the desirability of home ownership, with the tax advantages that accrue to it. Despite the squeeze being put on the mortgage-lending industry, housing prices rose as never before.

When nuclear families move toward single-family housing, multigenerational families dwindle. Grandparents cease to live with their kids and grandkids. This exacerbated the stresses on working mothers. Before they’d gone to work, they’d assumed the greater part of the responsibility for looking after their elderly relatives, while “exploiting” those relatives as ad-hoc child minders when Mom had to leave the house. In addition, various domestic necessities, including cooking and cleaning, began to be hired out in great degree.

Unless you’re my age or older, you might not have a sense of how new all of that was. The demise of the single-breadwinner family, for many decades the standard arrangement for nearly all Americans, carried a considerable shock. Few who lived through those years will soon forget the many changes it put us through.

Today we have another big wave of inflation coming. Congress’s radical borrowing-and-spending plans guarantee it. But today there’s no “untapped income resource” who can leave hearth and home to augment the family’s income. Along with that, many things have been added to the typical family’s list of “necessities.” Retreating from those expenditures, which only half a century ago would have been regarded as wholly discretionary, will be painful at best.

Once again, the political class will squirm to avoid the odium for inflation. Politicians only claim credit for good developments; they never accept responsibility for bad ones. The Usurpers are fully in control of matters. The probability is high that the weakening of the dollar and the consequences to the American sociopolitical order are part of their conscious intentions. After all, it will help them to create additional dependents – and dependents are easier to control than independents.

In light of the above, please also read (or reread) Hans C. Schantz’s thoughts on these developments. While he presented them in a fictional setting, the relevance to what has occurred and will be occurring cannot be gainsaid.

2 comments

I must re-read that book. Good story, but I honestly don’t remember that facet of it.

I remember the “floating of the dollar” in 1971. I was in the Navy at the time, stationed in Japan. One dollar at the time was worth 360 yen. After the dollar was “floated,” it immediately dropped to 330 yen, and continued to drop. By the time discharge came around, it was about 260 yen to the dollar. Thanks Dick.

At 360 yen to dollar, you could buy a new Mazda RX-3 (I loved those little rotary powered cars) for under 3 grand. Not so at 260.